Union Budget of India 2022-23 Summary

According to estimates, India's economic growth this year will be 9.2%, the highest of any large economy. The fact that the economy has rebounded and recovered so rapidly from the pandemic highlights our nation's resilience. During her presentation of the Union Budget in Parliament today, Union Finance and Corporate Affairs Minister Nirmala Sitharaman echoed this.

As part of the celebration of Azadi ka Amrit Mahotsav, the government aims to achieve the vision of the Prime Minister outlined in his Independence Day address and is embarking on Amrit Kaal, the 25-year-long build-up to India at 100. His vision includes:

- Adding a microeconomic level focus on all-inclusive welfare to the macroeconomic level focus on growth,

- The development of digital economy & fintech, technology-enabled development, and energy transition climate action, and

- Using a virtuous cycle that starts with private investment, followed by public capital to attract more private investment

Budget 2022: Areas of focus

- PM Gati Shakti

- Inclusive Development

- Productivity Enhancement and Investment

- Financing of Investment

Table of Content

- For the Agriculture and Food Processing Sector

- For the Education Sector

- For Health Sector

- For PM Gati Shakti Yojna

- Digital Currency

- For MSME Sector

- For Carbon Neutral Economy

- For Tax Proposals

- For Electronics Sector

- For Gems and Jewellery Sector

- For Some Other Miscellaneous Sectors

From 2014 onwards, the government focused on empowering citizens, especially the poor and marginalized, and initiatives were undertaken to provide housing, electricity, cooking gas, and clean water. Various programs are in place to ensure financial inclusion and direct benefit transfers, and to help the poor take advantage of every opportunity.

According to the Finance Minister, the Productivity Linked Incentive in 14 sectors to fulfill the vision of Atma Nirbhar Bharat has received an excellent response, potentially creating 60 lakh new jobs and requiring an additional production of Rs 30 lakh crore over the next five years. Regarding the implementation of the new Public Sector Enterprise policy, she indicated that strategic ownership of Air India has been transferred, a strategic partner has been selected for NINL (Neelanchal Ispat Nigam Limited), the issue of the LIC will happen soon, and others are in the planning stages for 2022-23.

For the Agriculture and Food Processing Sector:

- In the first phase, chemical-free, natural farming will be promoted all over the country with an emphasis on farmers' lands in 5-kilometer wide corridors along the Ganga River.

- It is planned to use "Kisan Drones", which are used for monitoring crops, digitizing land records, and spraying insecticides and nutrients.

- Increased domestic production of oilseeds will be implemented as part of a rationalized and comprehensive scheme to reduce dependence on imports.

- Taking advantage of 2023 being named the International Year of Millets, the government announced its full support for enhancing domestic consumption of millets, as well as branding millet products on a national and international level.

- With an estimated cost of Rs 44,605 crore, the Ken-Betwa Link Project will be implemented to provide irrigation benefits to 9.08 lakh acres of agricultural land, drinking water supply to 62 lakh people, 103 MW of hydropower, and 27 MW of solar power. A total of Rs 4,300 crores has been allocated for this project in RE 2021-22 and Rs 1,400 crores in RE 2022-23.

- The Centre has finalized the draft DPRs of five river links, which are Damanganga-Pinjal, Par-Tapi-Narmada, Godavari-Krishna, Krishna-Pennar, and Pennar-Cauvery, and will provide support for their implementation once a consensus is reached between the beneficiary states.

For the Education Sector:

- Skill development in relation to quality education will be addressed through Startups that facilitate Drone Shakti through a wide range of applications and Drone-as-a-Service (DrAAS). The courses required for skilling will be offered at select ITIs in all states.

- In 2022-23, 750 virtual labs in science and mathematics, along with 75 skilling e-labs for simulated learning environments, will be constructed to promote crucial critical thinking skills and to allow for creative thinking.

- PM eVIDYA's 'one class-one TV channel' program will be expanded from 12 to 200 TV channels to provide supplementary teaching in regional languages for classes 1-12 in order to build a resilient mechanism for education delivery.

- Through the Digital University, students will have access to universal, world-class education with personalized learning experiences at their fingertips throughout the country. There will be multiple Indian languages and ICT formats available.

- In a networked model, the University will consist of a hub and spokes, the hub developing cutting-edge ICT expertise. Public universities and institutions from across the country will form a hub-spoke network.

For Health Sector:

- An open platform will be developed for the National Digital Health Ecosystem under Ayushman Bharat Digital Mission. This platform will include digital registries for health providers and facilities, a unique health identity, consent framework, and universal access to healthcare.

- To provide better access to quality mental health services, the 'National Tele Mental Health Programme' will be launched.

- A network of 23 tele-mental health centers of excellence will be set up, with the National Institute for Mental Health and Neurosciences (NIMHANS) acting as the nodal center and the International Institute of Information Technology-Bangalore (IIITB) providing technical support.

For PM Gati Shakti Yojna:

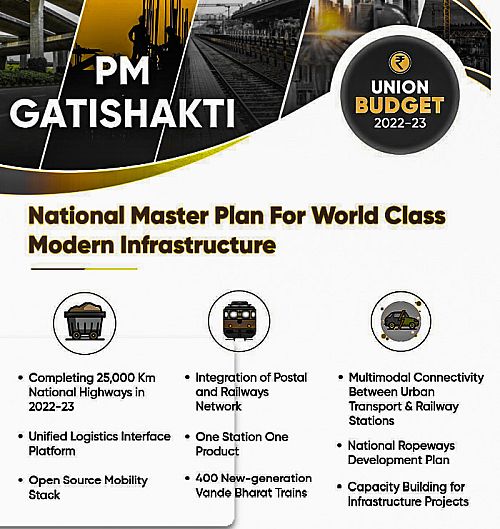

- PM GatiShakti promotes sustainable growth and economic development through a transformative approach. Specifically, the approach is driven by seven engines, namely, Roads, Railways, Airports, Ports, Mass Transportation, Waterways, and Logistics Infrastructure. These engines work together to drive the economy forward. Additionally, Energy Transmission, Information Technology, Bulk Water & Sewerage, and Social Infrastructure serve as complements to these engines.

- Additionally, the approach is driven by Clean Energy and Sabka Prayas, the efforts of the central government, state governments, and the private sector creating significant employment opportunities and entrepreneurship for all, especially youth.

- For faster movement of people and goods, PM GatiShakti will establish an expressway master plan in 2022-23.

- A network of 25,000 km of National Highways will be expanded by 2022-23, and Rs 20,000 crore of innovative financing methods will be utilized to supplement the public funds.

- In 2022-23, contracts for the establishment of Multimodal Logistics Parks at four locations will be awarded through the PPP model.

- To help local businesses and supply chains, the 'One Station-One Product' concept will be popularized in the railway industry. Furthermore, Amanirbhar Bharat will bring 2,000 km of the network under Kavach, an indigenous technology for capacity augmentation and increasing safety.

- We plan to develop and manufacture 400 new-generation Vande Bharat trains that will be more energy-efficient and provide better passenger experiences

- It is planned to construct 100 PM GatiShakti Cargo Terminals for intermodal logistics facilities within the next three years.

Digital Currency:

- To achieve a more efficient and cheaper currency management system, the government proposed introducing Digital Rupees, using blockchain technology and other technologies.

For MSME Sector:

- A credit line guarantee scheme called ECLGS (Emergency Credit Line Guarantee Scheme) has helped more than 130 lakh MSMEs mitigate the negative effects of the pandemic.

- Micro and small businesses are yet to regain their pre-pandemic level of business in hospitality and related services, and ECLGS will be extended until March 2023 after considering these factors. As part of this expansion, the guarantee coverage will increase by Rs 50,000 crore to a total of Rs 5 lakh crore, the additional amount being reserved exclusively for the hospitality and related industry.

- In the same vein, the Credit Guarantee Trust for Micro and Small Enterprises (CGTMSE) program will be reformulated with needed funds. As a result, Micro and Small Enterprises will receive Rs 2 lakh crore in additional credit and employment will be created.

- An outlay of Rs 6,000 crore over five years will be allocated to the Raising and Accelerating MSME Performance (RAMP) program to make the MSME sector more resilient, competitive, and efficient.

- ASEEM, Udyam, e-Shram, and NCS portals will be interconnected and their scope will be broadened.

For Carbon Neutral Economy:

- To catalyze private investment and demand in 2022-23, public investments must continue to be the driving force.

- As a part of its 2022-23 budget, the Union Budget proposes another sharp increase of 35,4% in capital expenditure from Rs 5.54 lakh crore currently to Rs 7.50 lakh crore. In 2022-23, the outlay will be 2.9 percent of GDP, more than 2.2 times what it was in 2019-20.

- Based on these investments as well as the provision made for the creation of capital assets through Grants-in-Aid to States, the Central Government's 'Effective Capital Expenditure' is estimated at Rs 10.68 lakh crore in 2022-23, which corresponds to 4.1 percent of GDP.

- Green Bonds will be issued in 2022-23 as part of the government's overall market borrowings for green infrastructure. Funds from the sale will be used to implement public sector projects to reduce the economy's carbon footprint.

For Tax Proposals:

On the Direct Tax Side:

- Correcting errors in tax returns is allowed within two years of filing the updated tax return. Persons with disabilities can also receive tax relief.

- Additionally, the budget reduces the minimum alternative tax rate for cooperatives, as well.

- In order to encourage startup businesses, the incorporation period has been extended by one year.

- To bring state government employees on par with central government employees, the budget proposes increasing the deduction limit on employers' contributions to the NPS account.

- A concessional tax regime will be offered to newly incorporated manufacturing entities.

- Income generated from the transfer of virtual assets will be taxed at 30%.

On the Indirect Tax Side:

- A fully computerized customs administration will be implemented in Special Economic Zones.

- A moderate tariff rate of 7.5% is applied to imports of capital goods and project imports as concessional rates are phased out gradually.

- In the budget, more than 350 exemptions will be gradually phased out as part of a review of customs exemptions and tariff simplification.

- To facilitate domestic electronics manufacturing, customs duty rates are proposed to be calibrated in a graded structure.

- A rationalization of the exemptions for tools and implements for the agri sector manufactured in India will be implemented.

- Customs duty exemptions are being extended to scrap steel.

- Differential excise duties will apply to fuel that is not blended.

For Electronics Sector:

- To facilitate domestic manufacturing of wearable, hearable, and smart meters, Customs duty rates are being calibrated to provide a graded structure.

- Other items eligible for duty concessions include parts of the transformers in mobile phone chargers, the camera lens in mobile camera modules, and certain other items.

For Gems and Jewellery Sector:

- Tax on cut and polished diamonds and gemstones will be reduced to 5 percent in order to give a boost to the Gems and Jewellery sector.

- The implementation of a simplified regulatory framework for the export of jewelry through e-commerce is scheduled for June of this year.

- Importers of imitation jewelry are being disincentivized from importing undervalued products through the prescription of a duty of at least Rs 400 per kilogram.

For Some Other Miscellaneous Sectors:

- A lower customs duty is being applied to certain critical chemicals like methanol, acetic acid, and heavy feedstocks for petroleum refining. In contrast, a higher duty is being applied to sodium cyanide, for which an adequate domestic capacity exists.

- Umbrellas will be taxed at 20 percent. Parts of umbrellas will no longer be exempt from tax.

- Exemptions on agri-tools and implements manufactured in India are also being rationalized.

- Steel scrap was granted a duty exemption last year, which has been extended for another year. A number of antidumping and CVD measures on stainless steel products, coated steel flat products, alloy steel bars, and high-speed steel are being revoked.

- There are exemptions provided to encourage exports on items like embellishments, trims, fasteners, buttons, zippers, lining materials, particular leather, furniture fittings, and boxes which are needed by those exporting handicrafts, textiles, and leather garments, leather footwear, and other items.

- To promote shrimp aquaculture exports, certain inputs are being subject to reduced duties.

- The government is striving to blend fuel. Fuels that are not blended will be subject to an additional differential excise duty of Rs 2/liter from 1st October 2022 in order to promote fuel blending.

Source: ATMANIRBHAR BHARAT BUDGET 2022

Union Budget of India 2022-23 Summary Union Budget Indian Union Budget Union Budget 2022 Budget Budget 2022 Budget 2022 Summary Union Budget 2022 Summary Union Budget Summary

Comments